The cryptocurrency market, long in the grips of a “crypto winter,” may have found its catalyst for revival: Donald Trump’s re-election. Known for his pro-business stance and unconventional approach to the economy, Trump’s return to the White House could inject fresh momentum into the digital asset space.

Renewed Focus on Economic Freedom

Trump has historically been sceptical of cryptocurrencies, famously criticising Bitcoin in 2019. However, his administration fostered policies that encouraged innovation, deregulation, and financial freedom—principles that align with the ethos of blockchain technology. A second Trump term could see a shift in his stance, particularly given the evolving role of crypto in global finance and his interest in countering centralized systems like China’s digital yuan.

Trump vowed to create a “Bitcoin and Crypto Presidential Advisory Council.”

“The rules will be written by people who love your industry, not hate your industry,” he said.

Market-Friendly Policies

During his first presidency, Trump championed tax cuts, deregulation, and economic policies that bolstered investor confidence. This approach, paired with potential initiatives to modernize financial systems, could create an environment ripe for blockchain innovation and crypto adoption. Speculation around pro-business legislation and the potential easing of crypto regulations under a Trump-led administration has already fuelled market optimism.

Institutional and Retail Optimism

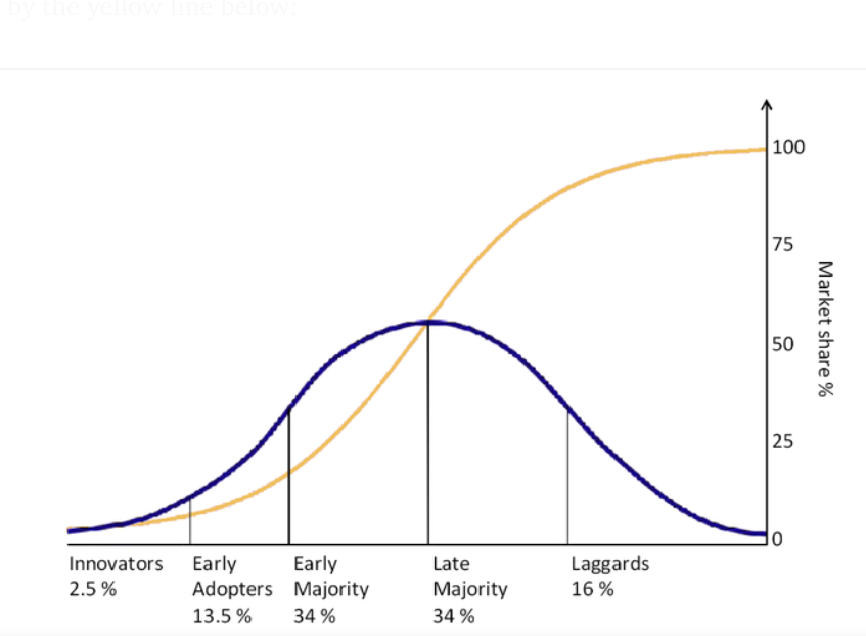

Trump’s influence on financial markets cannot be overstated. His presidency previously saw stock market highs, and a similar effect could be expected in crypto. Institutions eyeing blockchain adoption might accelerate their efforts, while retail investors, emboldened by economic optimism, could rush into the market. Adoption of new technologies often follows the Roger’s Technology Adoption Curve, and according to this, there is plenty of scope for both institutional and retail investment.

A New Bull Run?

Crypto markets thrive on narratives, and the “Trump bull run” might be the next big one. With his potential to redefine global economic policies, the stage is set for a seismic shift in the digital asset landscape. Could this be the spark that ends the crypto winter? The markets seem to think so.

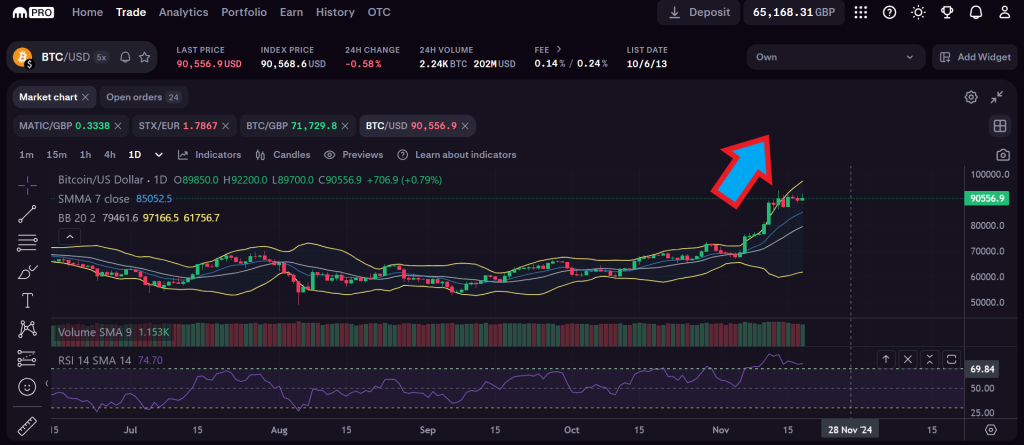

Since Trump’s election on November 6th, BTC has gone up 36%, reaching an all time high of over $93,000, before retracing slightly. Other crypto coins and tokens have mooned, including Sol, Ada, and various others. Several memecoins like Pepe, Doge, and Shiba Inu have moved up massively.

In the past, bull runs after the halving have lasted about a year. We shall have to see if this one follows the established pattern.

Prepare yourself—this could be the start of a new era for cryptocurrencies.